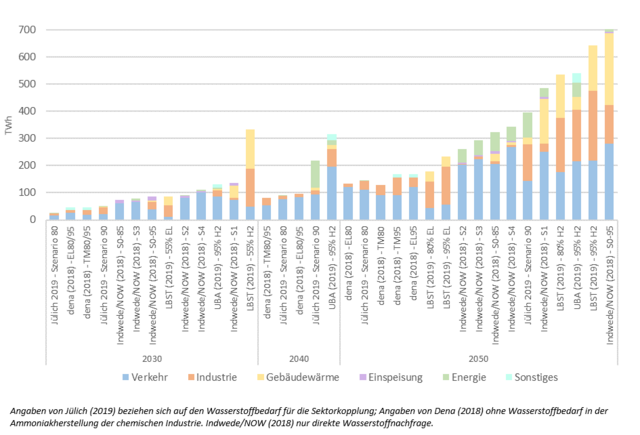

An analysis of specific sectors of industry was carried out to arrive at more precise figures on the extent of the future demand for hydrogen in Germany. The main focus in respect of the national climate control targets was on ambitious scenarios which assume a reduction of greenhouse gases of at least 90/95 % by 2050. Scenarios with a lesser degree of ambition were also included in the comparison, however, in order to be better equipped to present possible bandwidths in development.

The results of the evaluation of hydrogen demand scenarios in 2030 range between 45 TWh (1.36 million t H2) and 334 TWh (10.1 million t H2), with only one of the 14 scenarios having a forecast demand of more than 137 TWh (4.15 million t H2). Demand increases significantly by 2050 in all the scenarios under consideration. The resulting overall bandwidth in 2050 is relatively wide, ranging between 129 TWh (3.91 million t H2) and 706 TWh (21.4 million t H2). When it comes to sectoral use, sharp differences emerge between the research analyses. Many research analyses see transport as the primary sector for hydrogen use, although there is also a significant increase in use across industry as a whole. This is contrasted with a more extensive use of hydrogen in the heating of buildings in the most ambitious scenarios with a focus on hydrogen.

As regards the future use of hydrogen in the various sectors of industry, there are significantly different development trends in the scenarios identified. While the demand in materials chemistry will remain more or less constant in the long term, the steel industry is expected to need up to 80 TWh by 2050 due to an increasing switch from blast furnace-based production to hydrogen-based direct reduction. A significant decline is forecast in the refinery sector as a whole, dropping from the current level of around 23 TWh to an average of 1 to 2 TWh by 2050. It should be noted, however, that there is a limited number of scenarios relating to the demand for hydrogen in individual industrial sectors, indicating in some cases no specific level of ambition for greenhouse gas reduction.

Market prices and potential sales

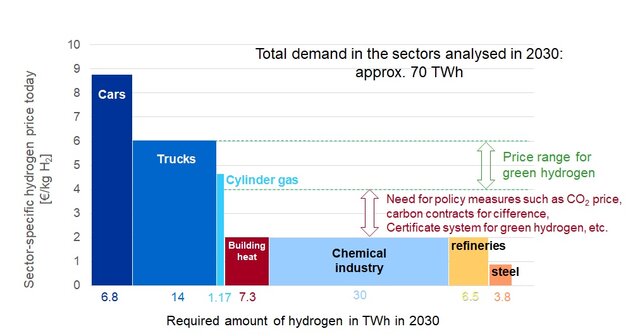

The levels of demand gleaned from the scenario analysis were used to construe possible sales volumes and achievable prices for green hydrogen. The prices currently paid as standard for hydrogen in relevant cases were converted into € per kg, allowing the generation of cost potential curves.

The average hydrogen demand will rise to around 70 TWh (2.12 million t H2) by 2030. Consumption is highest in the chemical industry, followed by the HGV segment, the building heating sector, the passenger car segment and the refineries. Based on the market prices paid today by end consumers, the cost is highest in the transport sector so this is located on the left side.

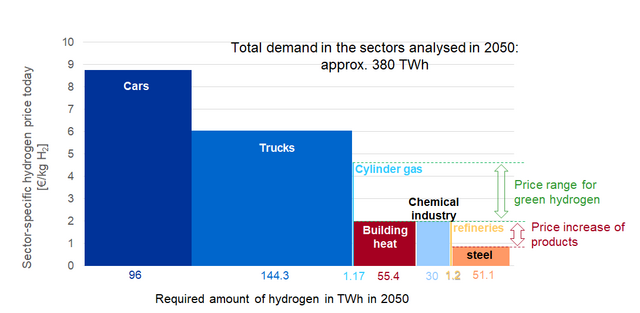

The analysis also included the hydrogen production and import costs forecast for 2030 and 2050 (see green dashed lines in graphs), allowing the market prices of the consumer industries to be compared with the costs of hydrogen and trading margins to be calculated.

The average hydrogen demand in the scenarios under consideration is set to rise significantly to almost 380 TWh (11.5 million t H2) per year by 2050. The predominant demand in 2050 will come from the transport sector, with the HGV segment accounting for the largest individual consumption, followed by the passenger car segment and building heat provision, ahead of the steel industry and the chemical industry.