// Future commercial potential

Assessment of the future potential in respect of electrolysis plants for enterprises in Baden-Württemberg

The looming dangers of climate change and the dynamic growth in demand for sustainable, climate-neutral business associated with these perils are confronting industry with a potentially serious structural change. It is difficult to predict what this will look like and which sectors it will affect and to what extent. The anticipated changes will, however, also open up new prospects and opportunities.

This is particularly true for enterprises in Baden-Württemberg, many of which could benefit from the boom in hydrogen use which is on the horizon. The possible sales potential for enterprises in Baden-Württemberg was sounded out in the “Electrolysis Made in Baden-Württemberg” project as a basis for an assessment of the resulting economic opportunities. Given its promising future, the scope for creating jobs in this field as a logical outcome was also identified.

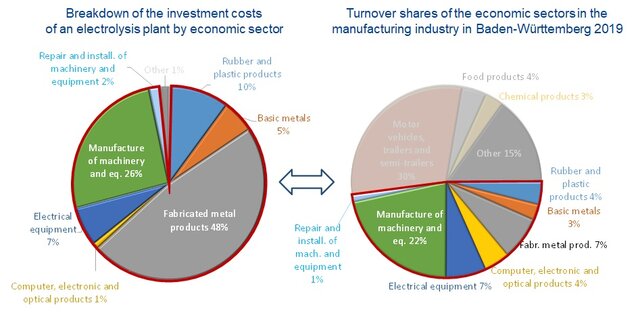

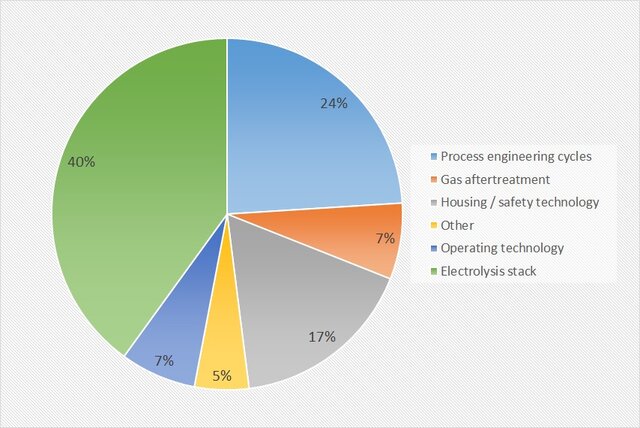

The analysis of the component structure of electrolysis plants based on the example of alkaline high-pressure electrolysis and the allocation of the assemblies and functional parts to the respective economic sectors shows which branches might benefit in particular from an expansion of the relevant technologies. Many of the components can also be used for other electrolysis systems (e.g. power electronics, water supply) therefore the results can also be transferred to other types of electrolysis systems (PEM, SOEC) with certain limitations.

Seen against the economic profile of the manufacturing industry in Baden-Württemberg, it is clear to what extent the skills required to make it easier to start producing components for electrolysis systems are already basically in place. The results show that practically all the parts of the system can be pointed out on the map of economic sectors already present in Baden-Württemberg to a significant extent. It was confirmed by experts in accompanying discussions that the sectors required for the manufacture of electrolysis systems and electrolysis components are also basically in possession of the relevant know-how. They would have to be mobilised for production, however, following on from the successful start made in these and other matters through the industry-wide discussion accompanying the “Electrolysis Made in Baden-Württemberg” project.

There is a need to estimate the possible total market for electrolysers in order to be able to extrapolate the advantageousness of the structure of the manufacturing industry in Baden-Württemberg and in order to be able to make an assessment of potential sales, including through the export of systems and components in particular. The starting point for this is the future development of the demand for green hydrogen worldwide. The electrolysis capacity required to meet this demand is extrapolated from the quantities required. It will be possible to arrive at final figures on the scope for generating sales and creating jobs with the help of further information, such as data on the increase in capital expenditure for investment in various electrolysis technologies, on degrees of efficiency, and on the share in world trade taken by Baden-Württemberg enterprises.

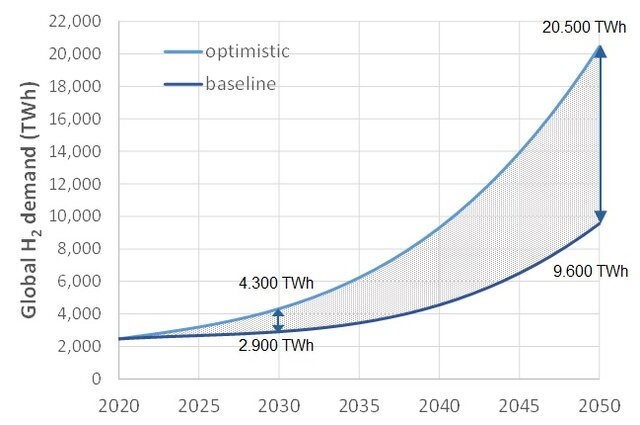

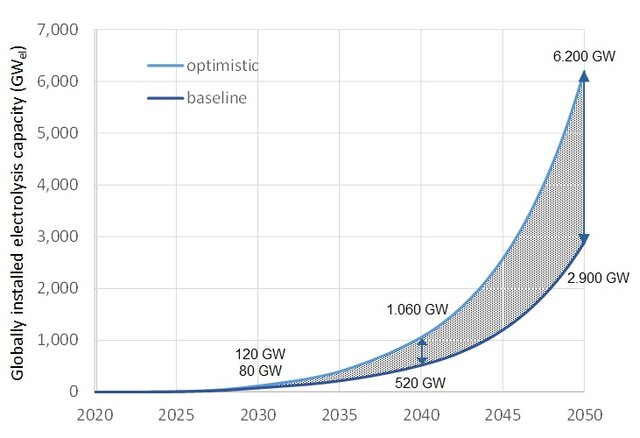

The demand according to the Sustainable Development Scenario (SDS) in the World Energy Outlook 2019 report is set at the lower limit (“baseline”) for the movement in global hydrogen demand. This assumes a rise in the global demand for hydrogen, increasing to about 2,900 TWh by 2030 and to around 9,600 TWh by 2050. The optimistic outlook is based on the evaluation of current scenarios which take due account of the need for widespread use of hydrogen resulting from the decision taken by the European Union to achieve climate neutrality by 2050. This will raise the demand for hydrogen worldwide to approximately 4,300 TWh in 2030 and to around 20,500 TWh in 2050. This wide gap shows the great uncertainty of future hydrogen use worldwide.

The worldwide demand for the necessary production capacity of electrolysis plants can be calculated on the basis of global hydrogen demand – assuming that the share of green hydrogen on the world market will gradually increase to 100 % by 2050. The required electrolysis capacity will be 80 to 120 GW by 2030 and 2,900 to 6,200 GW by 2050, depending on the scenario.

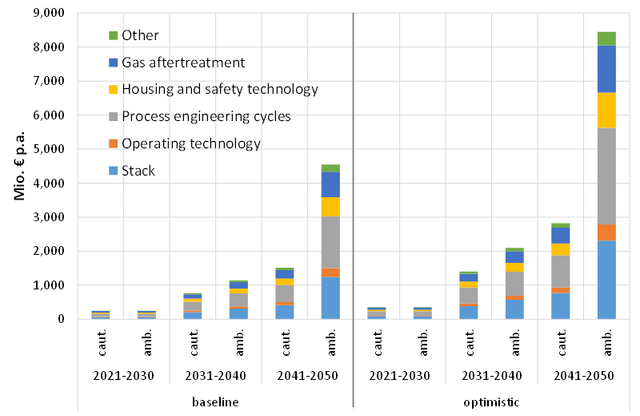

The scope for generating sales and creating jobs for Baden-Württemberg was calculated from the plant expansion needed on an annual basis and the capital expenditure required (including spending on replacements and plant maintenance) with reference to shares in world trade held by Baden-Württemberg enterprises in specific sectors of industry. Two possible trends were taken into consideration in this process. The ambitious trend assumes that the enterprises in the federal state will succeed in maintaining their current (industry-specific) shares in world trade in the future. The assumption in case of the cautious trend was that the current shares in world trade would remain stable until 2030 and then halve by 2040 and fall to a quarter of the current level by 2050, which experts believe is plausible as a possible course of development.

The average annual sales potential is between 0.8 and 2.1 billion euro per year, depending on the assumed world market share and depending on the progression in the demand for hydrogen in the decade from 2031 to 2040. Potential sales averaging 1.5 to 8.4 billion euro per year were calculated for industry in Baden-Württemberg for the period from 2041 to 2050. The associated scope for employment (taking into account industry-specific labour-capital ratios) is approximately 3,600 to 9,700 jobs for 2031 to 2040 and around 6,600 to 36,900 jobs for 2041 to 2050. In 2019, by way of comparison, around 162,000 and 335,000 people were employed in the metal product manufacturing and mechanical engineering sectors respectively in Baden-Württemberg.